what is a fit deduction on paycheck

On a pay stub this tax is abbreviated SIT. What is the fit tax rate for 2020.

What Is The Fit Deduction On My Paycheck

What is a fit deduction on paycheck.

. The rate is not the same for every taxpayer. Take a look at your pay stubany amount labeled as fica is a contribution to those two federal programs. My tax return could use such a brilliant.

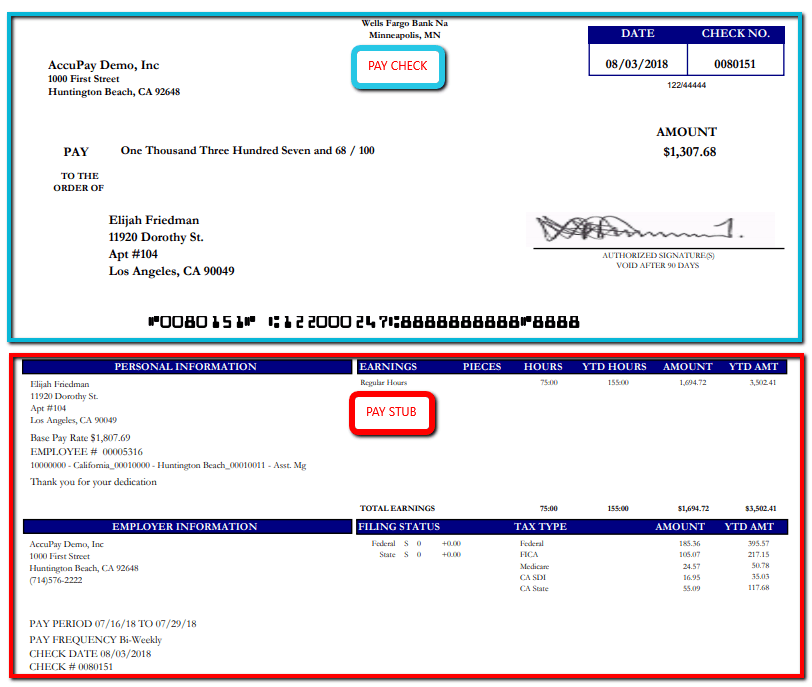

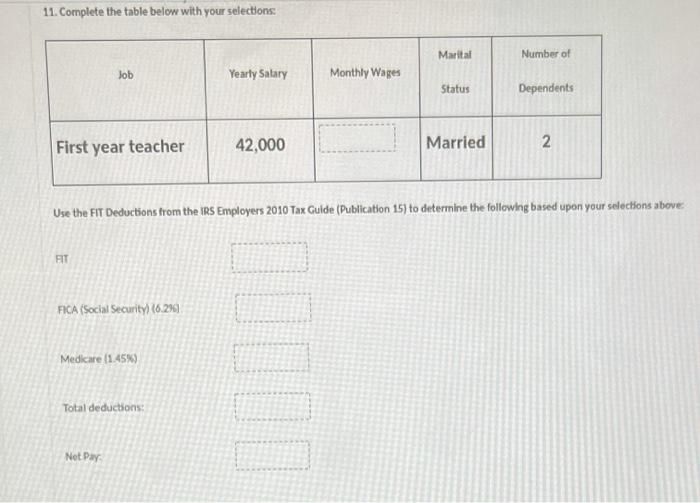

Withholding is one way of paying. FIT is applied to taxpayers for all of their taxable income during the year. This amount is based on information provided on the employees W-4.

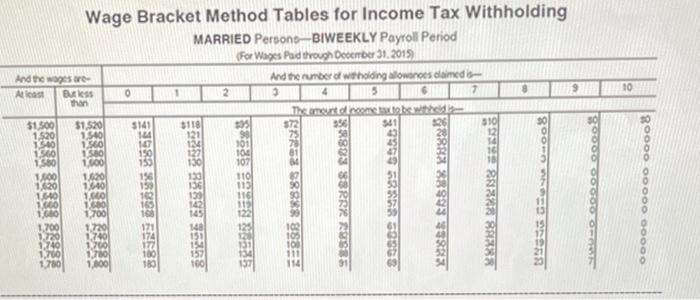

3 3PDF Deduction Gross pay State income tax SIT. Read on for more about the federal income tax brackets for Tax Year 2019 due July 15 2020 and Tax Year. FIT is the amount required by law for employers to withhold from wages to pay taxes.

FIT stands for federal income tax. Fit is the amount required by law for employers to withhold from wages to pay taxes. Calculate Federal Income Tax FIT Withholding Amount.

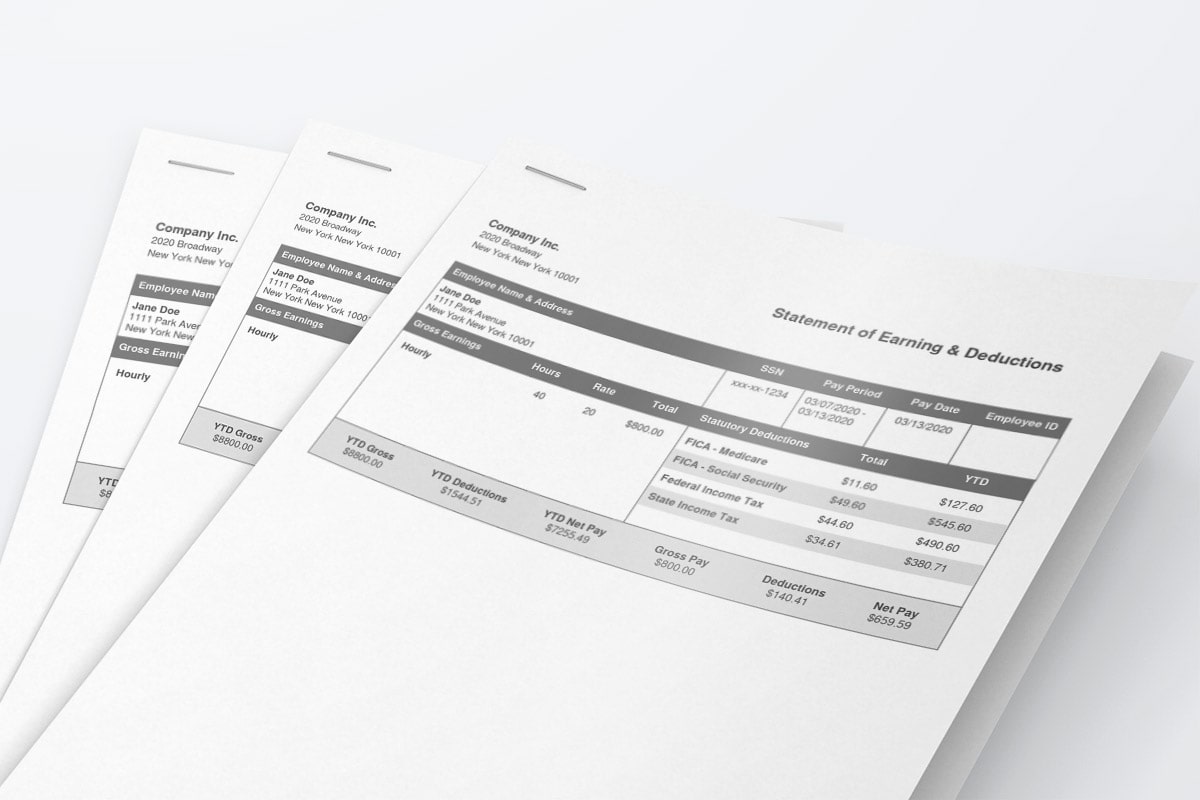

These items go on your income tax return as payments against your income tax liability. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable. With this information you can prepare for tax season.

The federal income tax rates remain. Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. First fit deduction is an IRS Tax Code feature that allows you to deduct the cost of wearable.

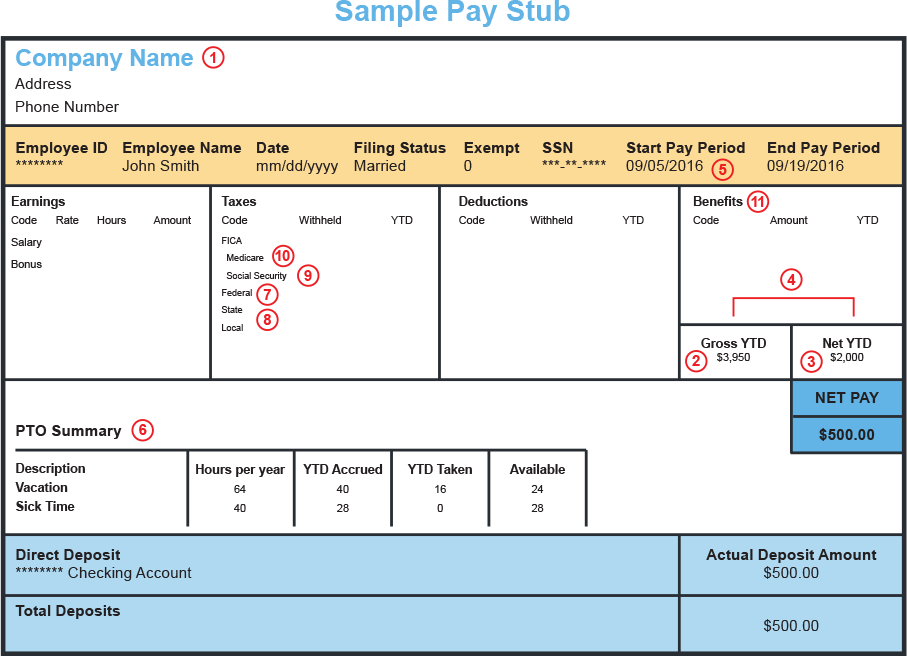

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay. Take State Income Tax. The FIT deduction on your paycheck represents the federal tax withholding from your gross income.

FIT Fed Income Tax SIT State Income Tax. There are a few things you should know about fit deduction on your paycheck. FIT tax refers to Federal Income Tax.

On every paycheck employers have the obligation to withhold and remit to the government the federal income taxes owed by their. Some are income tax withholding. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxesFIT deductions are typically one of the largest deductions on an.

The result is that the FICA taxes you pay are. Answer 1 of 2. Calculate Social Security and Medicare Deductions.

On a pay stub this tax is abbreviated SIT which stands for state income. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions. The Federal Income Tax is progressive so the amount will.

The income brackets though are adjusted slightly for inflation. 2 2Federal income tax FIT withholding Gusto Help Center. The amount of FIT withholding will vary from employee to employee.

For example a single employee making 500 per weekly paycheck may have 27 in. For example a single employee making 500 per weekly paycheck may have 27 in federal income tax. FIT is applied to taxpayers for all of their taxable income during the year.

What it is and how it affects wages and withholding. The rate is not the same for every taxpayer.

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com

What Is A Payroll Deduction Plan Forbes Advisor

Understanding What S On Your Paycheck Xcelhr

Pre Tax Vs Post Tax Deductions What Employers Should Know

Your Paycheck Tax Withholdings And Payroll Deductions Explained

How Much Does Government Take From My Paycheck Federal Paycheck Deductions

Fringe Benefits Rules For 2 S Corp Shareholders Cares Act Changes

How To Calculate Federal Income Tax

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Where Does All Your Money Go Your Paycheck Explained

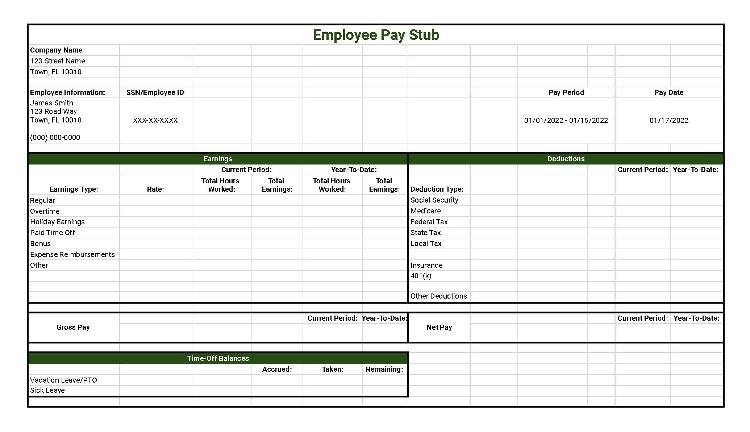

A Guide On How To Read Your Pay Stub Accupay Systems

![]()

How To Calculate Payroll Taxes Step By Step Instructions Onpay

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

Calculating Federal Income Tax On Form 1040 2014 Ppt Video Online Download

What Are Pay Stub Deduction Codes Form Pros

Free Pay Stub Templates Tips Laws On What To Include

Solved Find The Fit For Each Paycheck Using The Tables Chegg Com

How To Calculate Federal Income Tax

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube